Back

Russian Crude Builds at Sea as Indian Refiners Dial Back Purchases

Russian Crude Builds at Sea as Indian Refiners Dial Back Purchases

Russian oil is once again stacking up offshore. As Indian refiners reduce intake and European sanctions tighten, millions of barrels are sitting on tankers with no clear discharge plan.

For shipowners, charterers, and marine operators, this is more than geopolitics — it’s a live operational and freight market issue.

Russian Exports Slip from Recent Highs

In the four weeks to January 25, Russia exported around 3.18 million barrels per day (bpd), according to vessel-tracking data. While broadly stable week-on-week, that figure is roughly 680,000 bpd below pre-Christmas levels and marks the lowest export rate since August.

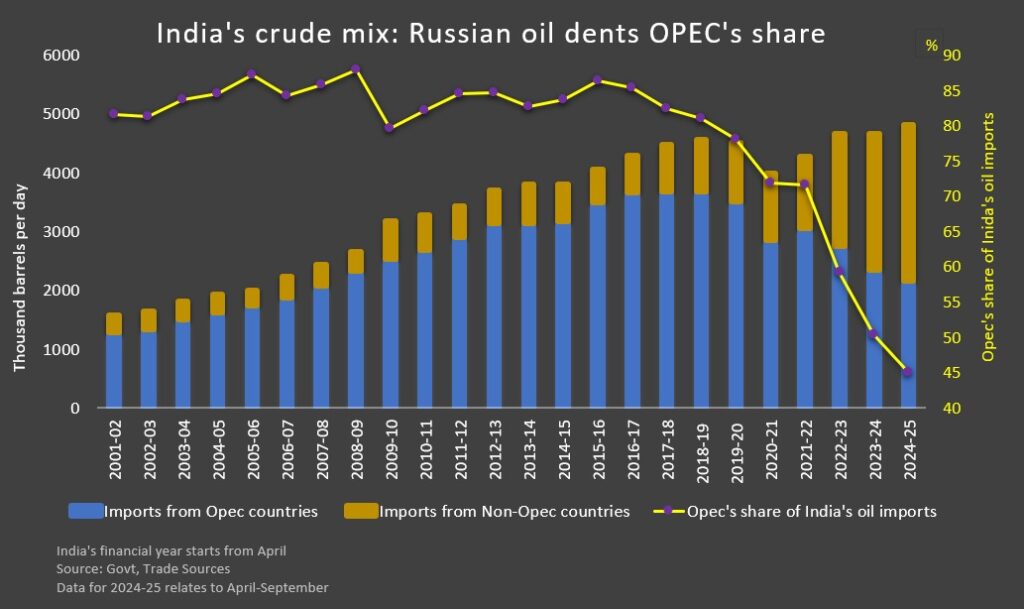

The real pressure point lies in India.

Deliveries into Indian ports fell sharply in December to about 1.2 million bpd, the weakest level in over three years. Early January figures suggest imports slipped further to roughly 1.12 million bpd.

The timing is notable. On January 21, the European Union implemented a ban on refined products made from Russian crude — a move that affects refiners processing Russian barrels for export

Tankers Waiting, Routes Changing

With Indian demand softening, tankers have begun accumulating offshore.

More vessels are idling near India and Oman, though some that left Omani waters have simply repositioned closer to India’s coastline. Others have redirected toward China. Only a single vessel in this floating backlog has managed to discharge.

At the same time, Russian traders appear to be turning to alternative storage options. Several cargoes have recently been discharged into storage facilities in Karimun (near Singapore), Balikpapan (Borneo), and Tanjung Intan (Java) — suggesting Indonesia is acting as a buffer zone for unsold barrels.

Total Russian crude held on tankers has stabilized at about 140 million barrels. That number is lower than earlier estimates due to data revisions, but the build-up trend remains intact. Roughly 60 million barrels have been added at sea since late August.

In short: supply is moving, but final buyers are less predictable

Sanctions Pressure Intensifies

The regulatory environment is tightening.

European and UK authorities are increasing scrutiny of vessels linked to sanctioned Russian oil trades. Last week, the French navy seized the tanker Grinch in the Mediterranean. Within hours, two tankers departing Murmansk reversed course and returned to port.

Such events create immediate uncertainty for ship operators — particularly those involved in “shadow fleet” or opaque ownership structures. Route diversions, insurance complications, and compliance reviews are becoming more frequent.

Refining & Shipments: Mixed Signals

Despite reduced exports, Russian refineries have not meaningfully increased throughput. Processing rates in early January were still running around 5% below normal seasonal levels, even as Ukrainian attacks on oil infrastructure eased.

Weekly export volumes remain volatile. In the week to January 25, 31 tankers loaded 23.39 million barrels, equivalent to about 3.34 million bpd, up from the previous week. Baltic ports — particularly Primorsk and Ust-Luga — drove the increase.

Export revenues have edged higher. On a four-week basis, crude export value rose to around $920 million per week, helped by slightly firmer prices:

- Urals (Baltic): $38.44/bbl

- Urals (Black Sea): $35.98/bbl

- ESPO (Pacific): $47.43/bbl

- Delivered India price: $56.27/bbl

Where Is the Oil Going?

Flows to Asia — including cargoes without declared final destinations — averaged about 2.98 million bpd in the four weeks to January 25.

However, declared shipments to:

- China dropped to around 840,000 bpd

- India fell to roughly 330,000 bpd

- Turkey eased to 170,000 bp

At the same time, approximately 1.81 million bpd is currently sailing without a confirmed final discharge port.

Many vessels list interim destinations such as Port Said or Suez before revealing final ports once they are deep into the Arabian Sea. Some never formally update destination signals at all.

Transit times are increasing. Ships are waiting longer to discharge in China and India, and some have diverted mid-voyage from India or Turkey.

Syria remains an opaque but active buyer. Tankers bound for Baniyas typically go dark south of Crete, only reappearing on satellite imagery near discharge.

Why This Matters

- For shipowners: Longer voyages, waiting time, and diversions increase freight earnings potential — but also raise compliance, insurance, and operational risks

- For charterers and operators: Destination uncertainty complicates scheduling, demurrage calculations, and fleet positioning.

- For refiners and traders: India’s reduced intake reshapes discount dynamics and may push more barrels toward China or secondary storage hubs.

- For compliance teams: Sanctions enforcement is becoming more visible and interventionist. Vessel seizures and sudden route reversals are real operational threats.

China Shifts Soybean Buying Back to Brazil After Meeting U.S. Trade Target

29 Dead in Basilan Ferry Sinking as Philippines Grounds Operator’s Entire Fleet

Maersk Tankers Installs First Suction Sails in Major Wind Retrofit Push

Russian Crude Builds at Sea as Indian Refiners Dial Back Purchases